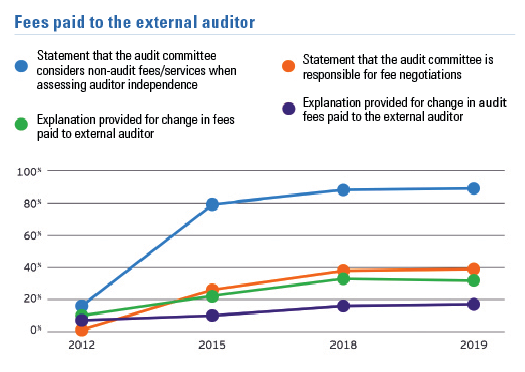

Disclosure of Auditor Fees is on the Rise

Most companies provide an explanation for the types of services included within each fee category, according to a report by EY's Center for Board Matters. Reviewed companies explained the circumstances for the change. Nearly 90% of companies disclosed that the audit committee considers non-audit fees and services when assessing auditor independence vs. just 16% in 2012. Companies vary on how they report the explanation, but they are all on the rise.

Source: EY Center for Board Matters, “What audit committees are reporting to shareholders in 2019”

A Comp Committee By Any Other Name…

There's been a dramatic change to the role of the compensation committee as they have taken on not only the dollars and cents of annual pay, but also the management of human capital, according to a Willis Towers Watson study.

There's been a dramatic change to the role of the compensation committee as they have taken on not only the dollars and cents of annual pay, but also the management of human capital, according to a Willis Towers Watson study.

Succession planning and comp risk assessment are common responsibilities outlined in comp committee charters, but several companies also include broader human capital management issues as part of the committee's oversight.

Committee names are evolving to match the new roles and the rate of name changes (not using compensation or executive compensation), increasing nearly 2.5 times in the past four years over the four previous years; 26 companies changed their committee names from 2016 to 2019 compared with 11 companies from 2012 to 2015. There are a number of name variations  among S&P 500 companies.

among S&P 500 companies.

Source: Willis Towers Watson

CEO Turnover Higher than Ever

The experiences surrounding long-serving CEOs were a focus of Strategy&'s “2018 CEO Success Study,” examining turnover among chief executives at the world's 2,500 largest publicly traded companies from 2004 to 2018. Isolating the data from 2018 successions, it turned out to be a turbulent year, as the percentage of CEO turnovers rose to a record high.

- Long-serving CEOs generally deliver higher shareholder returns than shorter-serving CEOs and are typically succeeded by insiders in a planned succession. However, these successor CEOs significantly underperform and are much more likely to be forced out of office.

- Turnover among CEOs at the world's 2,500 largest companies soared to a record high of 17.5% in 2018 — 3 percentage points higher than the 14.5% rate in 2017 and above what has been the norm for the last decade.

- The overall rate of forced turnovers was in line with recent trends, at 20%. But the reasons that CEOs were fired in 2018 were different. For the first time in the study's history, more CEOs were dismissed for ethical lapses than for financial performance or board struggles.

Source: Strategy& (PwC), “2018 CEO Success Study”