Fighting short-termism by embracing purpose and all stakeholders.

By Martin Lipton

By Martin Lipton

At the request of the World Economic Forum, together with a team of my Wachtell Lipton colleagues, I prepared “The New Paradigm: A Roadmap for an Implicit Corporate Governance Partnership between Corporations and Investors to Achieve Sustainable Long-Term Investment and Growth,” which was issued in September 2016.

The new paradigm conceives of corporate governance as a voluntary collaboration among corporations, shareholders, and other stakeholders to achieve sustainable long-term value and resist short-termism. It provides a roadmap for boards to demonstrate that they are providing thoughtful, engaged oversight and that management is diligently pursuing credible, long-term business strategies.

As part of that project, I sought to create a foundation for broad-based consensus and, accordingly, in the drafting stage I tested the new paradigm with a number of major corporations and incorporated the feedback we received. In addition, we took into account the published stewardship and engagement policies of the major index funds and institutional investors.

The new paradigm is attuned to the significant influence and role of asset managers and institutional investors, and urges them to embrace stewardship principles, reject activists, and provide the support and patience needed for companies to pursue long-term sustainable strategies. It posits that, while sometimes there may be differences of opinion and changes may be warranted, corporations and shareholders are almost always better served by working together on a collaborative basis than by doing battle or allowing an activist to interpose itself.

Since the time that I initially proposed the new paradigm, a number of developments have prompted me to reassess and revise this framework, with a view to further tailoring it as a middle-of-the-road approach and enhancing its usefulness as a private-sector solution to combat short-termism, while hopefully warding off a new round of politically driven and potentially misdirected governmental intervention.

We have now updated the new paradigm and my colleagues and I have prepared a new version outside the auspices of the World Economic Forum.

We have now updated the new paradigm and my colleagues and I have prepared a new version outside the auspices of the World Economic Forum.

We have been mindful of the ever-expanding assortment of corporate governance frameworks, codes, and principles for boards and investors to consider, and have accordingly sought to integrate these frameworks with a view to offering the new paradigm as a comprehensive roadmap that could be adopted by all of the proponents of governance and stewardship guidelines.

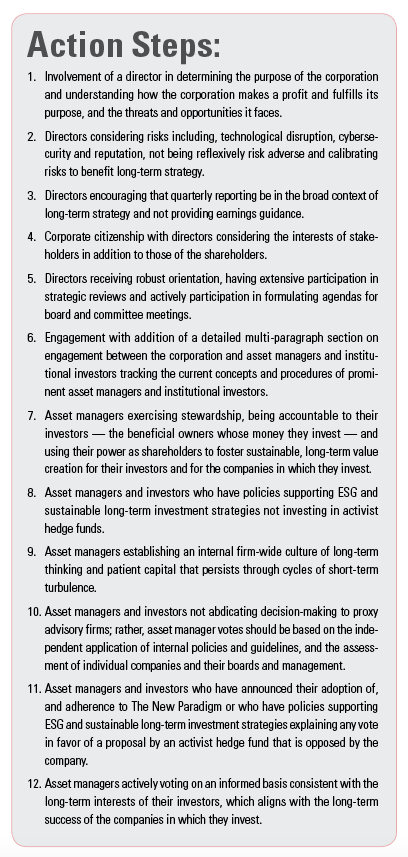

Corporations, asset managers, and institutional investors that embrace the new paradigm should endorse the efforts of the Investor Stewardship Group, Focusing Capital on the Long Term Global, the Coalition for Inclusive Capitalism, and similar organizations, to promote governance, stewardship and engagement principles consistent with the new paradigm. (See sidebar.)

No new legislation or new regulation is necessary to implement the new paradigm. Corporations, asset managers, and institutional investors can unilaterally announce their acceptance of and adherence to the principles of The New Paradigm.

Consistent with observations made by Chief Justice Leo Strine of the Supreme Court of Delaware, in his 2017 Yale Law Journal article, “Who Bleeds When the Wolf Bites?: A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System,” from both a corporate law and a trust law standpoint the principles of the new paradigm are intended to achieve long-term growth in value while eschewing actions and policies that threaten future growth and value, or the franchise itself.

Adoption of and adherence to the principles of the new paradigm is consistent with the fiduciary duties of boards of directors to their corporations and shareholders, and of asset managers to investors and the underlying beneficiaries for whom they are acting.

The new paradigm does not solve all the problems that corporations will continue to face, including challenges stemming from technological disruption, globalization, social media, and political instability, but it does take a significant step toward enabling corporations to better realize their potential to be drivers of broad-based socioeconomic prosperity today and in the future.

And by curbing destructive short-term activism, the new paradigm will negate a drift towards state corporatism.

Martin Lipton is founding partner of Wachtell, Lipton, Rosen & Katz, specializing in mergers and acquisitions and corporate policy and strategy matters; and a Directors & Boards editorial advisory board member.