What was the first board you joined?

Agree Realty Corporation was the first public board I joined. I was introduced to Joey Agree, the CEO, by a former board member who had known both Joey and me for about 25 years. Agree Realty was looking for a real estate capital markets person, which is my niche. Such an introduction is very helpful, as it provides support to your candidacy. What do you look for in a board? Chemistry — smart and nice people providing expertise and value-add on an array of topics. How does your professional experience inform your board service? Having been a REIT analyst for 18 years at Moody's — where I interacted with CEOs, presidents and CFOs of REITs daily — and as a former investment banker, tax attorney and portfolio manager for an opportunity fund, I understand the financials and goals of REITs.

Has virtual work affected REITs and if so, how?

Agree Realty Corporation is a good example of a REIT that made the transition to running the business online well. Agree is a retail net lease REIT with over 1,000 tenants. Most of [its properties] are single-tenant properties. More than 80% of the tenants were “essential” businesses, such as food and drug stores, that stayed open during the COVID shutdowns, so 99% of the rents have been received for months. Virtual work has affected REITs depending

upon their sector (retail, industrial, multifamily, healthcare, etc.), location and whether properties stayed open or had tenants physically in them. It's created a broader chasm among the A-, B- and C-quality companies and tenants.

Cybersecurity has been a constant issue for boards. How has that discussion evolved in the last several months?

Cybersecurity is very important, and companies have instituted quarterly tests of their systems and upgrade their databases consistently. The topic is always discussed to ensure the most recent protocols are being utilized.

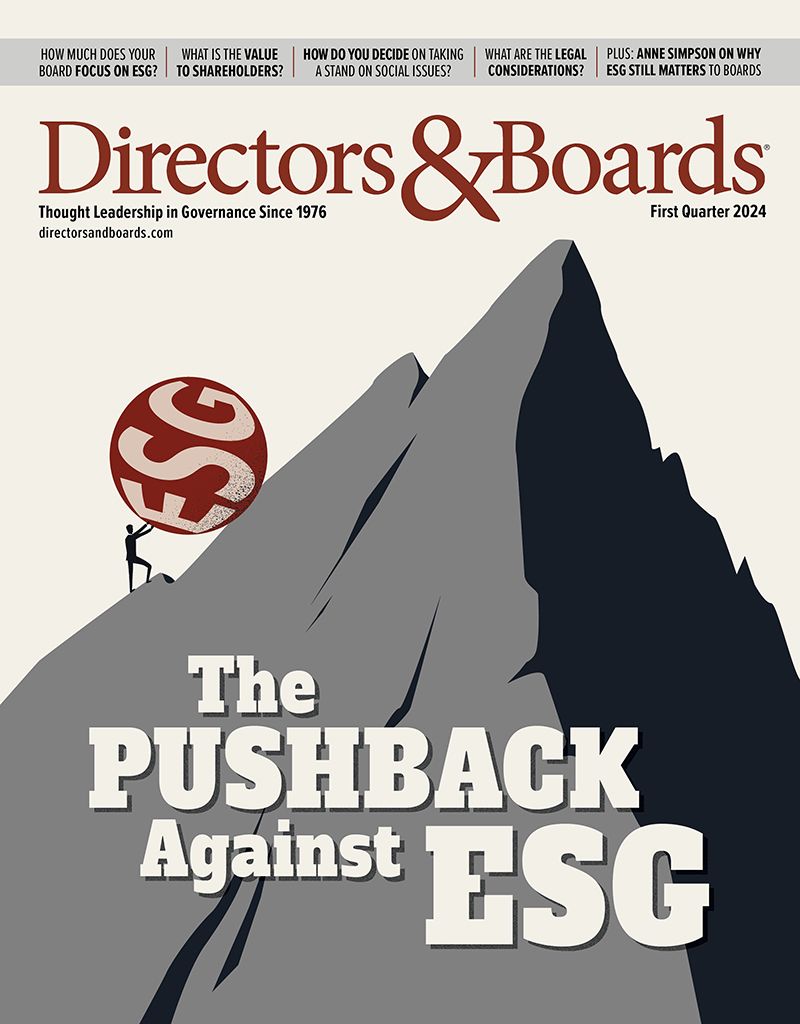

How have ESG issues changed since the spring?

There has been increased discussion about ESG over the past few years on earnings calls, in board meetings and on websites. Due to COVID, there is more discussion about ESG in a virtual world. Although the issues have not changed dramatically, the pendulum may have swung depending upon the effect of COVID, types of investments or governance issues each company confronts. The goal is to combine positive ESG outcomes with strong risk-adjusted returns for investors.

What do you think is a positive effect of the crises over the past year?

The 2020 pandemic accelerated in five months the implementation of advancing businesses online that might have taken another five years. It also highlighted the dichotomy between “essential” jobs that could not be conducted online and those that seamlessly moved online. For example:

- Boards: Public and nonprofit board meetings continued online, although it is nice having the personal interaction.

- Teaching: My Columbia and NYU classes were Zoomed, graduations occurred and students found jobs. However, the bottom line is that students of all ages do not absorb the content or focus as well online.

- Flexibility: Companies are evaluating jobs that can be continued online vs. ones that fare better in the office vs. hybrid environments now that it has became apparent how successful many businesses continued remotely. That augurs well for employee flexibility once the vaccines are given and the pandemic starts to subside. — As told to April Hall

To find out how to be featured in My Board Journey, contact April Hall at April.Hall@directorsandboards.com