DIRECTORS TO WATCH

Boards increasingly have to demonstrate a certain level of sensitivity and enlightenment as it relates to diversity in the boardroom.

Boards increasingly have to demonstrate a certain level of sensitivity and enlightenment as it relates to diversity in the boardroom.

But the question is, if a truly diverse group should reflect the demographics of the surrounding area and population, how does that break down for corporate boards?

The United States officially recognizes six racial categories: White American, Black or African-American, American Indian and Alaska Native, Asian-American, Native Hawaiian, and Other Pacific Islander. In addition to racial categories, the U.S. Census Bureau classifies Americans ethnically as Hispanic or Latino or not.

The summer 2016 census shows that white Americans are the racial majority, and African-Americans are the largest racial minority. After that, it gets confusing, mixing race with ethnicity, but in principle (and rounding up) whites account for 61% of the population, blacks for 13%, and Latinos for 18%, with the remaining 8% split among various categories of other.

So, what should a theoretical 12-person corporate board look like? Pure math doesn't solve the problem, and then there's a whole host of other factors. Is your company engaged largely in sales of consumer goods to, for example, the parents of toddlers and young children? Does that focus tilt the scales toward more women on the board, or not? Is it a provider of energy or petrochemicals or some other high-tech deliverable, suggesting perhaps that diversity on the board might be secondary to considerations of scientific or manufacturing acumen?

For boards, chief executives and chairpersons, this all presents a quandary: Do we as a board hazard being called to account for lack of diversity or are we convinced that everyone on the board is eminently qualified to weigh in effectively on the risks and opportunities confronting our businesses, regardless of racial/ethnic/gender splits?

Gender has been the biggest focus.

The state of California recently passed a law requiring a certain number of women directors on public company boards. It's not a stretch to believe that similar initiatives aimed at structuring ethnic and racial diversity in the boardroom are not too far behind. While legal challenges are sure to abound as these efforts evolve from ideas to policy, the trends are pretty clear.

Revealing a less “regulate-able” approach, albeit one that might be even more effective, State Street Global Advisors recently announced a new board gender diversity voting guideline. Beginning in 2020, State Street will vote against the entire slate of directors on the nominating committee of a company that has an all-male board and has not “engaged in successful dialogue on State Street Global Advisors' board gender diversity program for three consecutive years.” The power of the dollar in this case may be more compelling than the power of the pen.

Diversity, however, is more than just adding women to the board. Merely replace the word “gender” with the words “ethnic and racial” in just about any formula, including that of State Street, and it's easy to see where all this is going. Boards may not have to prove that ethnic and racial diversity has contributed to revenue growth or marketplace agility, but they have to prove they take it seriously.

“From the perspective of those concerned with effective corporate governance, increased diversity in the boardroom is a valuable and important goal,” according to a Sept. 21 memo authored by Theodore Mirvis and Kevin Schwartz of Wachtell, Lipton, Rosen & Katz. “One can readily appreciate the concerns of those who believe that achieving that diversity has taken too long. A robust debate about various methodologies and strategies for advancing the cause of diversity will doubtless yield results in the near term. Boards and investors share a common interest in this subject. The key is to find the right path forward, while recognizing that the time for removing all barriers to increased diversity is overdue.”

The authors don't even bother to quantify the kind of diversity they espouse. To do so would be old-fashioned thinking. Effective boards of the future will need to factor recognition that diversity of nearly every variety is at least good optics, if not a great platform for continued success, into the equation of board composition.

The following is a list of directors to watch who bring diversity and expertise to the boardroom:

Lauren C. States

Lauren C. States

Director, Clean Harbors, Inc.,

Webster Financial Corporation

Lauren C. States is an experienced technology executive, having spent her career at IBM addressing complex business challenges in a broad variety of roles including technology, strategy, transformation, sales and talent development. She was a leader in IBM's transformation to cloud computing, serving as chief technology officer in the corporate strategy function.

Lauren serves as an independent director on the publicly held boards of Clean Harbors, Inc. and Webster Financial Corporation. Across these boards, she serves as a member of the audit, risk, and environmental, health and safety committees. Lauren has a CERT certificate in cybersecurity oversight, issued by the NACD and Carnegie Mellon University.

Lauren serves on several nonprofit boards and was named one of the “Most Influential Black Corporate Directors” by Savoy Magazine in 2017.

She holds a B.S. in economics from University of Pennsylvania's Wharton School and completed a fellowship with Harvard University’s Advanced Leadership Initiative in 2015.

Best practices help define great governance: Fast-paced changes in industries and market dynamics, disruptive technological advancement, business model innovation, and an uncertain geopolitical landscape require boards to continually evaluate and enhance enterprise risk management oversight to help execute the strategy effectively and generate shareholder value. Best practices in this environment include regular discussions that encompass both current and emerging risks; mapping risk oversight against the board and committee structures; and assessing and remediating board skill gaps through education and/or director recruitment. High performing boards bring diverse experiences and expertise to these challenges, collaboratively identifying key areas for action while assisting in strengthening organizational resilience.

Cora M. Tellez

Cora M. Tellez

Director, HMS Holdings,

Pacific Premier Bank

Cora Tellez is founder and CEO of Sterling Health Services Administration. Sterling provides account-based services (HSA, FSA, HRA, Cobra,) linked to health benefits. Sterling also offers a new service called Amazing Care Network intended to help employers and employees navigate social and medical issues associated with care giving and aging. Tellez has 25 years of management experience in health care finance and delivery.

In October Sterling was named one of the Top Woman-Owned Businesses in the Bay Area and ranked number 20 of the Top Woman-Owned Businesses in the East Bay by the San Francisco Business Times.

Tellez currently serves on two publicly traded boards: HMS Holdings and Pacific Premier Bank. She also serves on two nonprofit boards: Institute for Medical Quality and the Hawaii Healthcare Alliance (board chair).

A duty of care and loyalty: It's an overused term, but it bears repeating: Boards owe a duty of care and loyalty to the company they oversee. To me, that has meant a focused role for a board to ensure three things: 1) the company's CEO's actions and motivations are aligned with the long-term success of the company, 2) promoting a culture of asking questions that probe how management is thinking about the risks and opportunities facing the company, and 3) creating within the board a respect for transparency and clear demarcation of roles (policy/strategy for the board; execution/operations for management).

Anna Catalano

Anna Catalano

Director, Willis Towers Watson, HollyFrontier Corporation, Frontdoor, Inc., Kraton Corporation

Anna C. Catalano has been a public board director for over 15 years. She currently serves on the boards of Willis Towers Watson, Kraton Corporation, HollyFrontier Corporation and Frontdoor, Inc., and is a certified board leadership fellow of the National Association of Corporate Directors, and board member of its Texas TriCities Chapter. In the not-for-profit sector, she is a member of the board of the Alzheimer's Association, the Houston Grand Opera, and co-founder of The World Innovation Network.

A renowned expert on the topics of marketing and strategic branding, corporate governance and leadership, Catalano is an outspoken champion for advancing women in business. As a fluent mandarin speaker with deep knowledge of Chinese culture, she has brought a unique perspective to global boardrooms. Having held executive positions in Asia, Europe and North America, she holds a broad perspective on the challenges of operating in a global environment.

Catalano has been recognized in Fortune magazine's ranking of “The Most Powerful Women in International Business.” She shares her thoughts on various aspects of leadership as author of the blog, www.shades-of-leadership.com.

The critical role of innovation: I recently heard someone say, “The pace of change will never be as slow as it is today.” With that in mind, directors in boardrooms must understand the critical role that innovation plays in sustained business success. A diverse board, made up of directors from different backgrounds, industries and generations, will yield insightful dialogue regarding disruption and innovation.

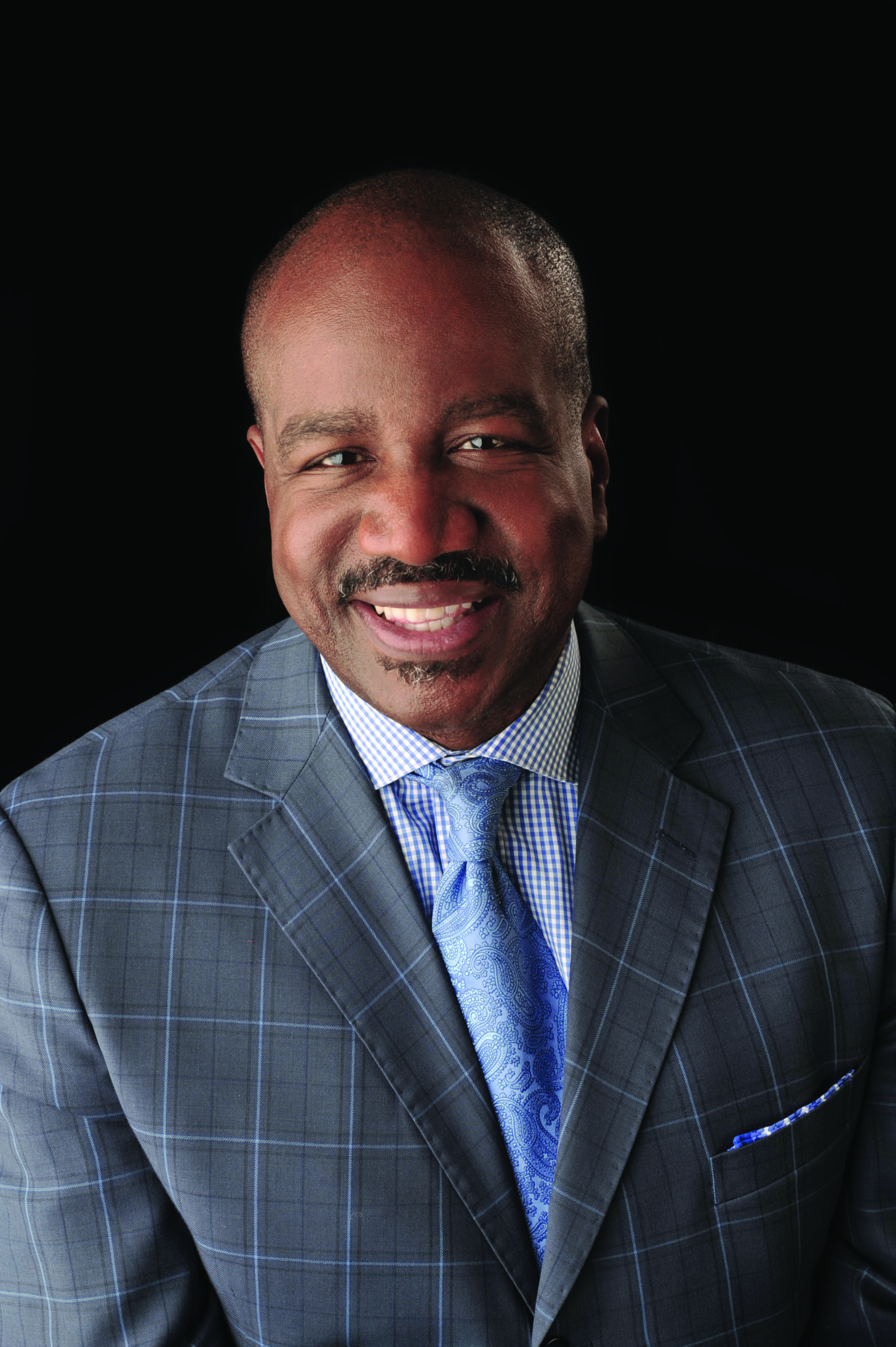

Calvin Butler

Calvin Butler

Director, Baltimore Gas and

Electric Company (Exelon)

Calvin G. Butler Jr. is CEO of Baltimore Gas and Electric Company (BGE), the nation’s first gas utility. He oversees safety, reliability, customer service, financial performance and BGE's commitment to creating an inclusive culture. He is a member of BGE’s board of directors and the executive committee of BGE’s parent company, Exelon.

Butler also serves on the boards of the Baltimore Community Foundation, University of Maryland Medical Center, Greater Baltimore Committee, Cal Ripken, Sr. Foundation, Center Club, Caves Valley Golf Club, Gridwise Alliance, RLI Corp, and as an independent trustee of the PNC Funds Board.

Additionally, Butler is board chair of his alma mater, Bradley University, and board member of the Institute of International Education and the Library of Congress’ James Madison Council.

The rationale for boards: Boards of directors are in place to ensure organizations fulfill their missions, stay true to their values and operate ethically and with integrity, in support of all stakeholders. They must balance competing and sometimes opposing interests. My passion for board membership is in helping organizations innovate for better results and greater community and economic impact, which ultimately improves people's lives. Like most large organizations, change is seldom swift and usually doesn't occur without challenges. I enjoy meeting those challenges head-on by first, acknowledging them, and then shoring up stakeholder support to collaboratively address the challenges and move the organization forward.

Joyce Cacho

Joyce Cacho

Director, Sunrise Banks, Land O'Lakes, Inc.

Joyce Cacho, CAMS, an experienced board director, brings strength in cybersecurity where her technology and brand-building expertise links software as a service (SaaS) to compliance, company performance, resiliency, and cultural and digital competencies. Knowledge of financial operations, including ESG intersection with the supply chain, data integrity/blockchain, and the relationship to M&A trends is another of Joyce's strengths.

Cacho is a board director of Land O'Lakes, Inc. — a Fortune 200 company, and Sunrise Banks, with a growing fintech/payments division. Committee experience includes finance & audit; compliance & Bank Secrecy Act; operating; and governance. Manufacturing, CPG, and innovation technology industries also inform Land O'Lakes, Inc., and Sunrise Banks. Distribution and services industries and REITs are ongoing interests.

Cacho is a member of CFA-NY and a NACD board leadership fellow.

Board governance agility is critical: Rapid change is the new normal, with technology presenting and redefining growth opportunities. The degree to which the board supports company valuation relies squarely on how best practices of governance are embedded in board programs. Engaging the CTO can be optimized by establishing a task force with members drawn from the audit and nom/gov committees, as an alternative to the technology committee. Listening and asking questions of the CTO about how technology changes will influence achieving business goals is critical. Board governance agility, in embracing the new normal of rapid change in technology, is pivotal to shaping and supporting an innovation culture.

Mei-Mei Tuan

Mei-Mei Tuan

Director, The Bancorp, Inc.

Mei-Mei Tuan is a managing director of Trewstar LLC. She is also the co-founder and chairman of Notch Partners LLC, a leading human capital partner to private equity funds.

As an investment banker with Goldman Sachs, BankAmerica and BankAustria, Tuan executed global real estate as well as structured and project finance transactions. Her operating experience includes serving as chief financial officer and chief operating officer at the Sierra Foundation and the San Francisco Food Bank.

She has been a director of The Bancorp, Inc. and its U.S. subsidiary since 2013 and is also a board member of the Clara Maass Medical Center and its foundation, and Montclair Kimberley Academy.

Tuan is a member of the Committee of 100, an organization that seeks to advance US-China relations.

Evaluations as a motivator of board performance: I am a strong advocate for board refreshment through term limits and robust self-evaluations. Businesses evolve and transform, and directors who may have seemed relevant previously, may no longer be as effective or engaged as they used to be. Having term limits and regular evaluations not only ensures that the board is well-suited to the particular business issues of the day, but also enables the nominating committee to constantly optimize for other factors, including diversity in background perspective and personality. Furthermore, the use of evaluations is a motivating factor for board members to stay diligent, and invested in their roles.

Hilda Pinnix-Ragland

Hilda Pinnix-Ragland

Director, RTI International,

NC Dental Services, Inc., 8 Rivers Capital

Hilda Pinnix-Ragland is a corporate affairs and business executive who most recently served as a senior executive with Duke Energy.

She serves on the board of directors of RTI International as chair of the governance and nominating and the audit committees, as an independent director of NC Dental Services, Inc., and 8 Rivers Capital, an energy technology company.

Pinnix-Ragland served in operating roles with Progress Energy, including vice president, northern region, with management of the construction and distribution of electric service, and as vice president, energy delivery services, with industrial, commercial, governmental and environmental compliance responsibilities. Pinnix-Ragland serves on the board of trustees for NC A&T State University, and is a NACD fellow, and a member of WomenCorporateDirectors and the Executive Leadership Council.

Read the small print: Corporate board structure, composition and annual evaluations are essential for strategic sustainable success. The structure of committees with adherence to bylaws, attendance, independence and external reviews by organizations such as NACD provide often complacent directors stronger board practices and reduces overall risk. Finding the right fit of board members must be deliberate with due diligence by the nominee and governance/nominating committee. Emotional intelligence is required in the selection process as members work as a team yet as individuals who confidently engage. Successful companies with world-class boards incorporate 360 evaluations to assess employee, customer, management, individual committee and overall board effectiveness.

Barbara J. Tanabe

Barbara J. Tanabe

Director, Bank of Hawaii

Barbara Tanabe is the owner of Ho‘Äkea Communications, a public affairs company, former president and CEO of Hill & Knowlton Hawaii, and a pioneer Asian-American broadcast journalist.

She has served on numerous public, private, and not-for-profit organizations, and is a director of Bank of Hawaii, chair of the board committee on trust services and a member of compensation and governance/nominating committees.

Tanabe is the founder and chair, Hawaii chapter, WomenCorporateDirectors, founding chair and director of Hawaii Institute for Public Affairs, president of Symphony AOUO (association of unit owners), and a director of American Judicature Society, Pacific Forum, Japan-America Society. She is a former director for East-West Center, Chamber of Commerce of Hawaii and Kuakini Health Systems.

Tanabe has been recognized with the YWCA Outstanding Achievement Award, Asian-American Journalists Association Award, and the University of Hawaii.

Board engagement at the local level: Boards are strengthened by independent voices representing the diversity of its community — in skills, experience, professional networks, cultural roots — as well as gender and ethnicity. Board engagement with our community organizations provides valuable perspectives from our customers, policymakers, employees and the range of businesses from entrepreneurs to global corporations. Board diversity ensures robust discussion on issues such as risk management, succession planning in a disruptive environment, impact of public policies on economic growth. As board members focus on the company's strategic initiatives, the strength of individual director's voices adds to the quality of the board's decisions.

Michael H. Millegan

Michael H. Millegan

Director, Wireless Telecom Group, WINDPACT

Michael H. Millegan is an independent board director for Wireless Telecom Group (WTG). He chairs WTG's compensation committee and is a member of the nominations and governance committee.

Millegan provides industry expertise to the board of VETT’D, an advanced talent management company that is pioneering the utilization of AI and data science to enhance staffing decisions. In addition, he is a board member of WINDPACT, a sports technology company bringing innovative solutions to athletic, military and recreational segments.

During his corporate career at Verizon, Millegan led several large scale and scope business units, including his key leadership role as president, Global Wholesale. He specialized in network infrastructure deployment, managing cloud computing, IOT, SDN, technology innovation and cybersecurity.

He is an expert on cybersecurity issues.

Staying ahead of the game: Effective boards are strategic advisers which help the firm define its goals and mission. With significant disruption and transformation occurring in every industry, the board's role is crucial to the long-term success of the entity. Being the chair of the compensation committee, I gain great insight in the key drivers of the firm's success. The committee must ensure strategic alignment between goals and pay practices. By doing this, shareholders and employees are reaping benefits while ensuring the viability of the company. The future impact of technology is something directors should strive to explore and stay current to be effective in their roles.

Janet S. Wong

Janet S. Wong

Director, Enviva Partners

Janet S. Wong, CPA, serves as independent board director and audit committee chairman of Enviva Partners, a leading global energy company in sustainable low carbon energy. She is an advisory board member of BigControls, a cloud-based software company.

Wong has demonstrated valuable leadership experience serving public, private and start-up companies at KPMG where she is a retired partner with national practice roles in technology and manufacturing as well as a global lead partner.

She volunteers as an executive advisor to Ascend, the largest nonprofit Pan-Asian organization for business professionals in North America. Her responsibilities include leading Ascend Pinnacle, the largest network of experienced Asian American corporate directors. She is a trustee for the Computer History Museum and past chairman of the Louisiana Tech College of Business advisory board.

Communications and collaboration are key: In the boardroom, diverse experiences offer varied perspectives which are essential for an effective board in dealing with the disruptive issues that are driving innovation in a fast changing corporate environment. An effective board that communicates and collaborates will be well-positioned to add value on strategic planning such as new markets and market competition, disruptive technologies such as AI, blockchain, big data and their impact on the company, critical issues such as cybersecurity, and most importantly in demonstrating a company's culture from the top.

Orlando Ashford

Orlando Ashford

Director, ITT Corporation

Orlando Ashford oversees sales and marketing, revenue management, deployment and itinerary planning, public relations, hotel operations and strategy as president of Holland America Line, an American-owned cruise line and subsidiary of Carnival Corporation.

He has been named to Black Enterprise's “Most Powerful Executives in Corporate America,” Savoy Magazine's list of “Top 100 Most Influential Blacks in Corporate America,” awarded a 2016 Travvy for “Most Innovative Executive, Mid-Sized Cruise,” and is a Purdue University School of Technology Distinguished Alumnus.

Ashford's book, Talentism, addresses the global disconnect between available jobs and the millions of eligible workers.

He is on the board of ITT Corp., chairman of the Executive Leadership Council, founding board member for Positive Coaching Alliance, Seattle chapter; and a Washington Roundtable member.

Diversity awareness a fiscal responsibility: I believe that being on a board of directors requires us to lead open, authentic conversations about race and the value of difference with those around us. It's only from that perspective that we'll create the trusted relationships that are required to place more African Americans and other people of color in international, large enterprise and C-suite roles. Research shows that diverse teams are more innovative and deliver better results. It should be a priority to build pipelines of talent from communities of color and ensure their participation in board and C-suite opportunities. It is a part of a director's fiscal responsibility.

Evelyn D'An

Evelyn D'An

Director, Enochian, Summer Infant

Evelyn D'An is an experienced independent board director, chair of audit, compensation and nominating/governance committees, CFO, former EY audit partner, and Hispanic business leader. She serves on the board of Enochian, a biosciences technology company, and Summer Infant, a consumer products manufacturer and distributor. Prior board service includes Hot Topic, a teen specialty retailer, and Alico, Inc., a land management and property developer.

D'An's experience spans the world's largest listed companies to startups and private equity backed investments providing leadership on strategy, capital structures, compensation plans, financial cadence, digital transformation, and operational design and metrics. She was the former senior vice president of finance for Brightstar, a $5 billion global distributor and wireless industry service provider. Evelyn spent 18 years at EY where she was an audit partner.

When to disrupt versus when to respond: Successful transformations within companies are those that begin with employees, executives and boards being aligned on culture, brand and purpose. Everywhere we look, innovation is happening at lightning speed and disrupting all industries. The real question is when to disrupt versus when to respond to the competition. Today, staying competitive means transforming the customer experience while also looking at your own workforce and culture. Boards need to have a pulse on the composition of their workforce. Successful innovation strategies are those that are inclusive and representative of diversity of experiences, perspectives and backgrounds.

Michael Day

Michael Day

Director, Recology, Inc.,

Topa Insurance Group, Somos, Inc.

Michael Day serves on the boards of Recology, Inc., a waste collection and recycling company, Topa Insurance Group, a personal and small commercial lines insurer, and Somos, Inc., the administrator for toll free numbers issued in North America. He chairs their respective audit committees and serves on various other committees. Day also serves on the board of Junior Achievement of Northern California.

Previously, Day was the chief financial officer for CSAA Insurance Group, a $3 billion personal lines insurer. During his tenure with CSAA, he was responsible for managing the company through significant investments and transactions.

Day has an MBA in finance from Columbia University and a B.B.A. from Baruch College. He is a certified public accountant licensed in the state of New York.

Create a winning strategy: A company's strategy should answer a critical question: How will we win? It should provide a litmus test against which its ambitions and ideas are tested and a “true north” which guides its forward progress. No amount of corporate talent or execution excellence can overcome the impacts of a poorly chosen strategy. High functioning boards will work closely with executive management to develop a company strategy. Board members must bring to bear their expertise, experience and business judgment, working with each other and with executive management, to create a winning strategy, one designed to surpass, surprise and outlast the competition.

Priya Cherian Huskins

Priya Cherian Huskins

Director, Realty Income Corporation

Priya Huskins serves on the board of Realty Income Corporation, an S&P 500 public company known as “The Monthly Dividend Company.” She chairs Realty Income's compensation committee and serves on both the technology risk committee and the corporate governance and nominating committee.

Huskins also serves on the board of Woodruff Sawyer, a 100-year-old private insurance brokerage. She chairs Woodruff Sawyer's compensation committee and serves on its corporate governance and nominating committee.

Huskins is a partner at Woodruff Sawyer where she consults on D&O insurance and risk mitigation matters, including ways to reduce exposure to lawsuits and regulatory investigations.

She also serves on the advisory board of the Stanford Rock Center for Corporate Governance and is the author of the popular D&O Notebook blog.

Collaboration is the answer: The answers to all of today's hard questions are found at the intersection of different disciplines. This fundamental insight can drive board excellence. Composing an effective board requires a variety of skills and experiences as well as a willingness to hear alternative perspectives. Individual contributors must have the will and the right chemistry to create an open environment in which different views can be fully debated before decisions are made. Not all successful business leaders are good at collaboration, so screening specifically for this set of skills is critical.

Rita Johnson-Mills

Rita Johnson-Mills

Director, Brookdale Senior Living, Inc.

Rita Johnson-Mills brings over 25 years of progressive executive level leadership experience to corporate boards. She spent over 15 years as a senior executive with Centene Corporation and UnitedHealthcare, of which her last role was CEO of UHC Community Plan of Tennessee. Over this time, Johnson-Mills received numerous honors and awards and was voted 2017 CEO of the Year by the Nashville Business Journal.

Among other appointments, Johnson-Mills serves as a member of the MyNexus advisory board and as an independent director on the Brookdale Senior Living, Inc., board.

Johnson-Mills holds dual master's degrees from The Ohio State University, one in labor and human resource management and the other in public policy. Johnson-Mills is a Hogan-certified executive coach and a Senn Delaney-certified corporate culture facilitator.

Cornerstones to organizational success: Consistent, reliable and focused governance is the cornerstone to organizational success. This allows for the identification of significant internal and external risks that if not managed will do significant harm to the corporation. Culture plays a major role in governance; a corporation that encourages robust dialog and forthright communications will outperform those that do not. Associate, client and shareholder trust is critical to success. Trust is also the hardest asset to restore so work hard to maintain it. Corporate directors have to create the balance between leaning in and keeping their fingers out!

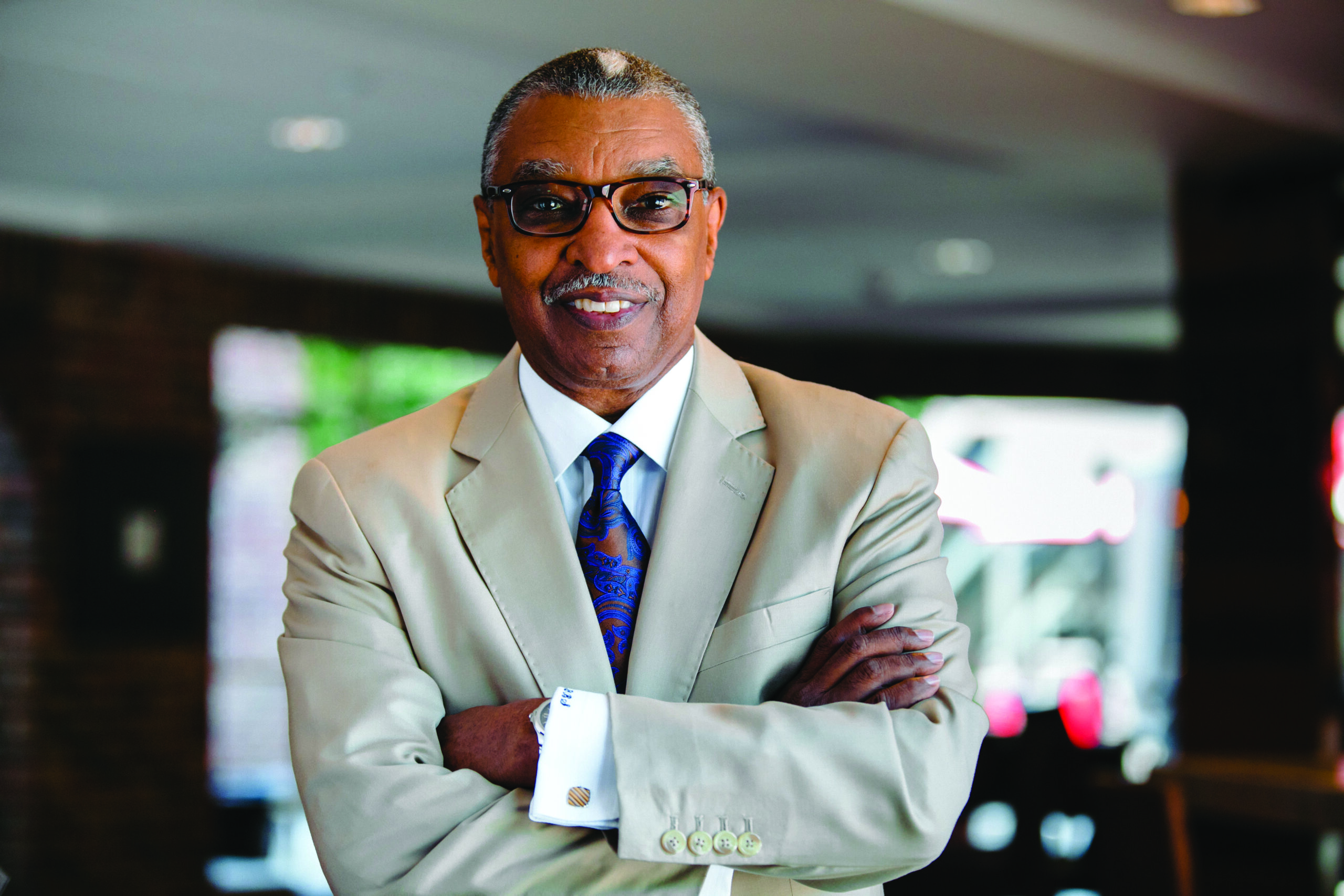

DeForest Soaries

DeForest Soaries

Director, Ocwen Financial Corp., Independence Realty Trust,

Federal Home Loan Bank of New York

DeForest B. Soaries, Jr., is the senior pastor of First Baptist Church of Lincoln Gardens in Somerset, N.J., former New Jersey secretary of state, and the author of the books Say Yes to No Debt: 12 Steps to Financial Freedom, dfree Lifestyle Workbook, and Meditations for Financial Freedom volumes 1 and 2.

Soaries earned a Bachelor of Arts degree from Fordham University, a Master of Divinity degree from Princeton Theological Seminary and a Doctor of Ministry degree from United Theological Seminary.

Soaries is a member of the board of directors at Ocwen Financial Corp., Independence Realty Trust and Federal Home Loan Bank of New York. He serves as the compensation committee chair on all three boards.

Take a look at age diversity, too: Ever since the VCR proved that older users require the assistance of younger people to successfully use new technology, there has been a growing consciousness that younger people are more likely to grasp the potential and functionality of emerging technologies. However, corporate governance has not kept pace with this reality. Despite the fact that cybersecurity is widely perceived to be a greater threat than terrorism and transitioning to cloud solutions is common, corporate boards are slow to embrace younger directors in boardrooms. If corporations do not embrace age diversity and recruit younger directors, they will be targets for disruption. When it happens, they will never understand what happened.

Alejandra “Ale” Spray

Alejandra “Ale” Spray

Director, Bellco Credit Union

Alejandra Spray serves as the marketing director of AMI Mechanical, Inc., in Denver, and manages AMI’s marketing and procurement strategies, plus community engagement and outreach efforts.

Spray serves on the board of directors and the board risk committee of Bellco Credit Union, the second largest credit union in Colorado, and chairs the board of HCC, a construction trade association focused on diversity. She also is appointed to the Colorado's Minority Business Advisory Council and serves as trustee for Avista Adventist Hospital.

Spray has over two decades of experience in the construction industry and holds a bachelor's degree in civil engineering from the Western Institute of Technology and Higher Education University in Mexico.

Spray was recognized as “2018 Business Developer of the Year” by Colorado’s Society for Marketing Professional Services.

Inclusive thinking is critical: Assembling an effective board is about the perspective of individual directors chosen, as well as the deliberate construction of relationships that allow for the effective execution of corporate governance and strategic oversight. As a director, I am motivated to communicate my perspective — a perspective that is focused on both the construction industry and workplace diversity — to warrant that the choices we make are always in the best interest of our members and of the communities we serve. Inclusive thinking is integral to ensuring our organization remains competitive, visible and sustainable.

Adis Vila

Adis Vila

Director, MessageComm

Multicultural and multilingual, Adis Vila, a Cuban refugee, came to the United States in 1962. In 1982 she was selected as a White House fellow. She is the former global head of international business development at Vigoro, former head of regulatory policy for the western hemisphere at Nortel Networks, former secretary and CEO of the Florida State Department of Administration, and former assistant secretary and COO of the U.S. Department of Agriculture.

A financial expert under SEC and NYSE rules, Adis retired from her position as the first chief diversity officer at the U.S. Air Force Academy in 2013 and founded Vila & Associates, helping clients build diverse leadership and inclusive organizational culture.

Vila is on the board of MessageComm and a trustee of the Southern Center for International Studies. In October Vila was elected to the board of Latino Corporate Directors Association, beginning in January 2019.

Retaining talent by building an inclusive culture: Successful boards understand that the only constant facing global businesses today is change, and that boards themselves are an important part of that transformation. Directors, individually and as a group, must foster diversity of thought among board members and executives and set a tone and create a culture that values human capital, encourages employee engagement, and inspires innovation. Without such an inclusive culture the best and brightest leave, making it increasingly difficult for companies to compete successfully.

Jan Fields

Jan Fields

Director, Chico's FAS, Welbilt Corporation

Jan Fields is the former president of McDonald’s USA. A respected public speaker, Fields is an advocate for women's career development and an accomplished marathoner.

Over her 37-year career with McDonald's, Jan held every operations position from the restaurant to the executive suite. She has been named to Forbes' World's 100 Most Powerful Women, Fortune's 50 Most Powerful Women in Business and the Wall Street Journal's 50 Women to Watch.

Jan serves on Chico's FAS and Welbilt Corp boards. She previously was on the board of Monsanto for 11 years and chaired the board of Buffalo Wild Wings. She is also on the Ronald McDonald House Charities Global board of trustees and Women Corporate Directors, and is the former chair of Catalyst board of advisors.

Relied upon to ask the tough questions: With today's increasingly complex governance needs and issues, directors play critical roles in the success of the businesses and organizations they serve. Acting on behalf of shareholders — who are growing more diverse and vocal all the time — they have immense responsibilities in the areas of ethical behaviors and legal issues, and are relied on to ask the tough questions.