Fortune 100 Increasing Voluntary Audit-Related Disclosures

EY's Center for Board Matters recently reported that a U.S. survey of investors indicates high degrees of confidence in the audited financial information disclosed by public companies, with more voluntary reports than ever before.

Some key findings:

-

In 2018, 71% of companies disclosed the length of auditor tenure. In 2017, the percentage was 64%, and in 2012 it was 25%.

-

62% of companies disclosed the factors used in the audit committee's assessment of the external auditor qualifications and work quality, while in 2017 and 2012 the percentage was 58% and 18%, respectively.

(Source: EY Center for Board Matters)

What's the Tone At the Very Top?

The Role of Boards In Overseeing Corporate Ethics & Compliance

LRN, an ethics and compliance consultant, recently conducted in-depth, off-the-record interviews with 26 chief ethics and compliance officers (CECO) of major companies. The interviews revealed that, despite aspirational statements of company values, ethics and compliance is not a high operational priority of their boards of directors.

Some more in-depth findings from the report:

• Nearly half of CECOs say that their board has not received education and training on their E&C responsibilities.

• About 40% say their boards have not done a “deep dive” on compliance failures and scandals, despite recent Department of Justice regulations requiring them to do so.

• Only about 40% of CECOs reported that their boards have metrics in place for measuring E&C effectiveness.

• Only 40% of CECOs say that their boards of directors are willing to hold senior executives accountable for misconduct.

• Over 50% say that boards spend two hours or fewer working on E&C each year.

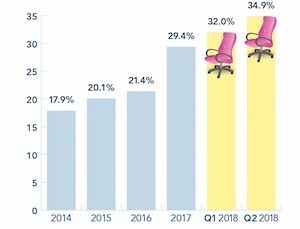

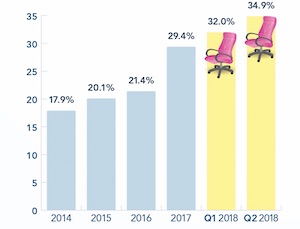

New Board Seats Increasingly Going to Women

The Equilar Gender Diversity Index found that one third of new directorships went to women in Q2 2018, almost a two-fold gain from 2014.

(Source: Equilar Gender Diversity Index)

Shareholder Activism Puts Short-Term Pressure on the Board

At your organization, to what extent has short-term pressure from external sources compromised management's focus on long-term strategic goals?

Director Education

• 45% of board respondents said not enough time was allocated to director education in board meetings over the last 12 months.

• The amount of time directors currently dedicate to formal education is 21 hours annually, a slight increase from last year, when it was 18.5 hours.

Board Evaluations

• 60% of respondents now evaluate individual director performance in the evaluation process, up from 41% last year.

• Most individual director evaluations are conducted annually (89%); it is less common to conduct them every two years (9%) or three years (5%).

(Source: NACD Public Company Governance Survey 2017-2018)