Balancing CEO comp satisfaction, pay ratio disclosure fallout, and intensifying scrutiny over big and inequitable paychecks.

Few boards would appreciate the recent national headline on Time.com: “This CEO Makes 900 Times More Than His Typical Employee.”

Few boards would appreciate the recent national headline on Time.com: “This CEO Makes 900 Times More Than His Typical Employee.”

The story focused on Marathon Petroleum's CEO's nearly $20 million compensation, the requirement this proxy season for corporations to report CEO pay, and how that compares to the median play for employees.

In local news, the Kansas City Star covered the disclosures by calculating how long it would take an employee to earn one year of what a CEO's pay. For example, Commerce Bancshares' median employee would need to work 90 years at 2017's pay to equal CEO David Kemper's $4.87 million.

Corporate leaders across the country have been preparing for the fallout from the new CEO pay ratio disclosure requirement, a rule that was part of the Dodd-Frank financial law. Unfortunately, it comes at a time when boards are facing pressure from many sides.

It's like a compensation “seesaw” directors are trying to balance, says Aubrey Bout, managing partner for Pay Governance, a compensation committee advisory firm.

Boards, he continues, are balancing the tension between motivating and retaining the CEO and pleasing all the other stake-holders, including employees, investors, proxy advisors, regulators, etc. “I see boards agonizing; they're being pushed and they're nervous,” he maintains. “We haven't seen this in a long time.”

Quelling employee ire

There is a “heightened sensitivity to pay packages that could be deemed ‘excessive',” regarding executive and director pay, according to the recently released 2018 Compensation Committee Guide, from corporate law firm Wachtell, Lipton, Rosen & Katz. (See box on managing compensation risk.)Indeed, the eye-popping headlines in the media were expected by many directors, but the top focus in the boardroom is on how employees will react to the news.

“When this first came up, one of the things my comp committees asked – all of them — was, ‘How do we communicate this to employees?'” says Wendy Lane, a director for Willis Towers Watson, MSCI Inc., and Upm-Kymmene Oyj. “Our first priority is employees because talent is the name of the game for any company.”

|

Compensation Risk Law firm Wachtell, Lipton, Rosen & Katz's Compensation Committee Guide points out disclosure rules require information in the proxy statements about the board of directors have a role in managing risk and “the relationship between a company's overall employee compensation policies and risk management.” Here's some advice from the guide: The compensation committee should not be involved in actual day-to-day risk man-agement. Directors, however, need to be confident that management has designed and implemented risk-management processes that • Evaluate the nature of the risks inherent in compensation programs, • Are consistent with the company's corporate strategy, and • Foster a culture of risk-aware and risk-adjusted decision-making throughout the organization. And, the firm recommends organizations “consider including on the compensation committee a member of the audit or other committee that oversees risk generally. Through a coordinated approach, the board of directors can satisfy itself as to the adequacy of the risk oversight function and understand the company's overall risk exposures.” |

Boards have been “vigilant” about figuring out how to share the information, adds Steve Odland, CEO of the Committee for Economic Development who sits on the board of directors for General Mills, Inc. and Ana-logic Corporation. “Boards need to be sensitive to it and there needs to be a communication plan,” advises Odland, a former CEO of Office Depot and AutoZone. “Sophisticated investors already understand it, so the issue is going to be employees of company.”

The burden, he continues, is going to be on human resources departments. Boards should help HR think through how to handle pay disclosure and they need to make it clear, he adds, that compensation is market-based.

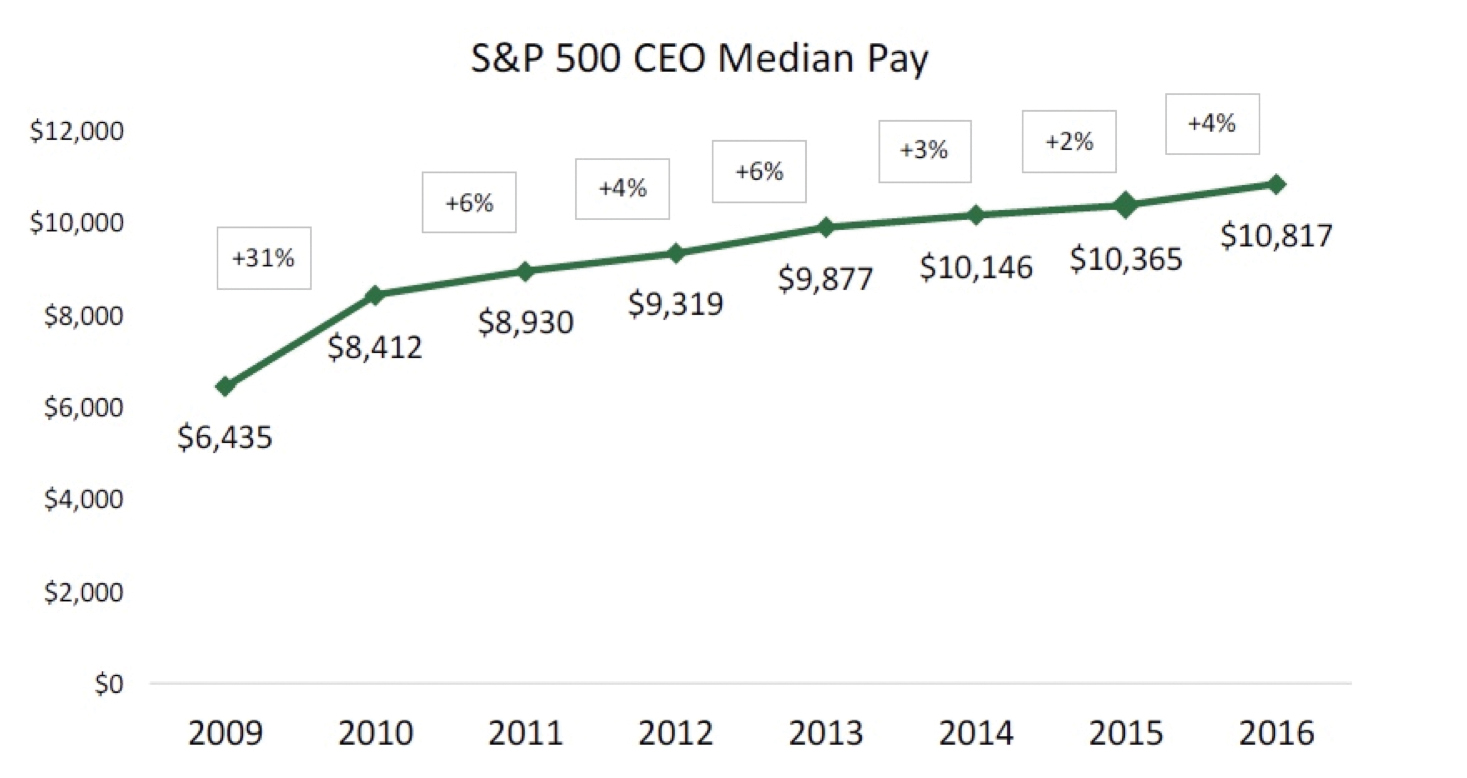

Indeed, given that many companies are growing and the stock market is strong, Pay Governance's Bout says he expects to see median pay for CEOs rise again this year, after increasing 4% in 2016.

“I'm seeing that CEOs definitely have leverage on their boards,” he says. “Now we're at a point where CEOs are definitely bolder, and asking for bigger pay increases.”

Tax windfall could mitigate disparities

When it comes to evaluating CEO pay, there are a lot of things on the minds of directors and comp committees, including the CEO pay ratio and tax reform, notes Irv Becker, vice chairman, Executive Pay & Governance, Korn Ferry Hay Group.

Plenty of attention has gone to the Tax Cuts and Jobs Act and the windfall that's resulted for companies, he points out. “A lot of talk has been about increasing minimum wage or passing along to employees in the form of bonuses. There's an expectation that the salary growth for the masses is going to start picking up some momentum.”

|

Related Story: |

On the flip of that, he continues, “There will be sensitivity to moving CEO pay too much. CEO pay has outpaced the broader population, and comp committees are sensitive to that. There will be some conservatism as it relates to CEO pay, maybe more so than what we've seen.”

Becker sees it as a positive if companies can take the windfall and pass it along to their employee population and help retain and attract the talent that they need; while at the same time raising that median pay. As for CEO pay disclosure, Becker says his firm is advising clients to spend more energy and time on the potential fallout from employees who are below the median pay internally and those who see their pay is below that of competitors.“

|

How does ISS plan on using the CEO pay ratio disclosure data? Directors & Boards asked Patrick McGurn, special counsel and the head of strategic research and analysis at Institutional Shareholder Services Inc. (ISS), a leading proxy advisory firm: “We've started pulling the data out of the proxy statement disclosures. They are appearing in our proxy reports to our clients if they want to make use of it – the ratio, the number itself and the median employee pay. “We put it right next to, as part of an existing chart, the internal pay equity numbers in relation to senior executives at their own firms and to their peers. So investors will give it whatever weight they want to give it. We make sure they're getting it in a usable fashion. “We have not, to date, integrated the numbers into our voting policies. At end of season we'll go back and talk to our clients; and it will be part of our client survey as well. “By and large, when we talk with clients, people want peer comparisons and want year-over-year data to look at the trends. Until we have a substantial amount of information in hand, you can't come up with a meaningful peer comparison.” |

It's important for the HR organization to be ready to talk about the employee value proposition,” he explains. “It's not the board's purview to be dealing with broad-based pay in the organization. That's really delegated to the CEO and CHRO [Chief Human Resource Officer] to make sure they're paying competitively. The board should be making sure HR is thinking about this, understands the issue, and is ready for it.”

The board should be thinking more high-level, he adds, helping to frame what a company's philosophy is around pay. “These kinds of conversations happen at the comp committee level. The board may be asking management what their plans are? For example, how are they going to be using the windfall? Board members have an opinion and can chime in, provide strategic direction.”

What's your organization's pay philosophy?

RJ Bannister, director and practice leader for executive compensation, North America, at Willis Towers Watson, has seen more companies “taking a step back and thinking about their overall pay strategies and pay philosophies and making sure they are aligned with the business strategy they want to accomplish.”

|

Proxy Statement's Role in CEO Pay Defense The best defense against criticism of the multiple of CEO pay versus employee median pay is to state in the proxy statement. The proxy statement is the document critics will look at to determine how the CEO is paid. Therefore, the statement needs to reflect what the board will use to defend their CEO compensation decisions. The content of the statement can be used as talking points in the event the chairman is ever interviewed on this subject. And consistency is key. Important elements to include in the statement: • The company has a robust process in place to set CEO compensation and to evaluate CEO performance. • CEO compensation is based on the competitive compensation survey data and that which is required to attract and retain a talented individual needed to lead the organization. • A portion of the CEO's compensation is at risk, based upon whether objectives set by the board of directors are achieved. • The categories of what those CEO objectives are (for example, achievement of revenue and earnings goals, long-term strategic objectives, tone at the top, organizational culture, etc) As a board, ensure the company's process in place to set CEO compensation and to evaluate CEO performance is followed. When asked about the disparity between CEO compensation and the median employee pay refer to the elements of the proxy statement. Stan Silverman, the former CEO of PQ Corporation, a global chemicals and engineered glass materials company, is vice chairman of the board of trustees of Drexel University, and he has served on numerous public, private, private equity and nonprofit boards.

|

It's the concept of “human capital risk,” he explains, and boards should consider whether they need a talent committee to address such issues.

“The comp committees have a piece of talent, but they're primarily focused at the top. So they're reacting to issues as opposed to having them be a part of their agenda,” he says. “The CEO pay ratio is imbedded in the whole notion of fair pay,” he adds, and that's pushing boards to think differently about talent.

“Yes, you can use comp to address the issue today, but what are the actions you're putting in place structurally to address the problem going forward? That's a more complicated answer.”

Boards, he continues, should ask about what other types of analytics should be analyzed — not just the quantum of the pay — and also how that relates to performance They could also look at overall income and how much is going to the employee population versus shareholders. He adds, “While so much of executive compensation has been individually focused, I see it evolving into looking at groups: What is it in finance com-pared to the CEO, senior management versus middle management, versus employees?”

Pay ratio could unearth bias

The pay ratio disclosure requirement may open the flood gates when it comes to com-paring pay, but it also could unearth data on whether women or minorities are more like-ly to fall below the median. While that's not information companies are required to disclose, it's data that could provide a reality check for management and the board. And it could pose problems if employees take it upon themselves to compare where certain groups fall on the scale.

Even if there are legitimate explanations for pay disparities, if you have a situation where the majority of women are below the median, that's going to raise concerns and companies need to be ready to address those issues, stresses Dan Marcec, a spokesman for Equilar, a board intelligence solutions firm.

Boards could play a role here, reviewing pay programs and policies, Bannister adds. For example, if a company sees a gender pay gap, which could emerge during the pay dis-closure process, they may want to consider whether to take the tax windfall and address the gap.

“A lot of companies are going to want to dissect the ratio into components and understand where they are at,” he says, when it comes to pay disparities and also how pay stacks up to competitors.

Pay equity and diversity are areas that are growing in interest among investors, but it's unclear It's difficult to know what employees are going to find concerning before the actual numbers are released, especially for companies that have tens of thousands of employees around the world. Among the companies where Lane is a board member, the proxies that will include the ratio have yet to be filed, and at this point her boards are not going to guess out front what may become an issue.

“We are going to provide our leaders and management people a set of facts so when people call they'll have the answers,” she says. “This year, no one knows how people are going to react,” she adds. “Depending on how they react, then you can have a backup plan; have the CEO do a webcast, or some-thing like that. Next year is going to be easier.”

Talent, she stresses, “is our most important resource, so we want to make sure our employees are well incented and not put off by some sort of artificial number.”